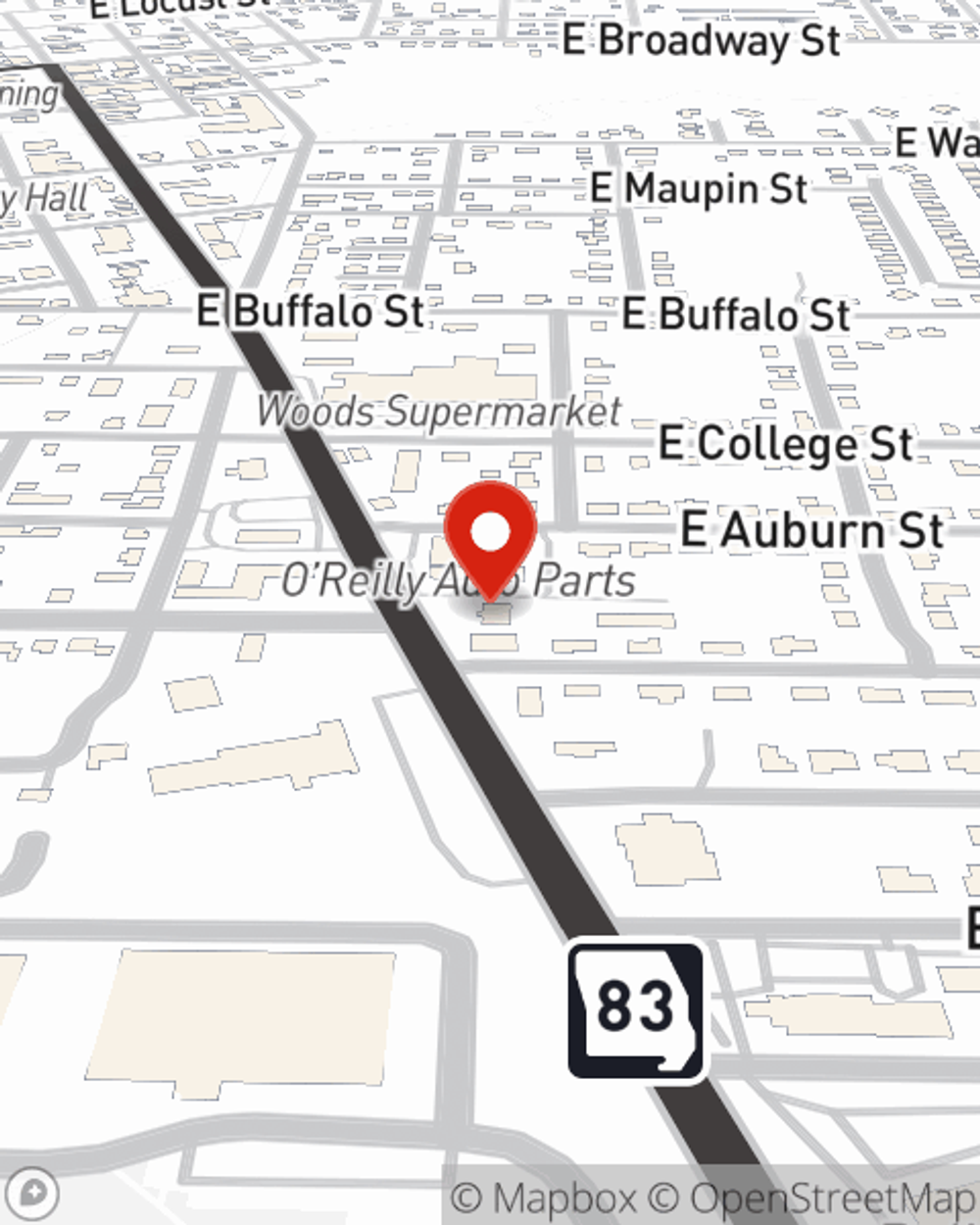

Business Insurance in and around Bolivar

One of the top small business insurance companies in Bolivar, and beyond.

No funny business here

- Bolivar, MO

- Pleasant Hope, MO

- Pittsburg, MO

- Polk, MO

- Morrisville, MO

- Fair Play, MO

- Humansville, MO

- Halfway, MO

- Fair Grove, MO

- Brighton, MO

- Weableau, MO

- Hermitage, MO

- Wheatland, MO

- Louisburg, MO

- Preston, MO

- Urbana, MO

- Aldrich, MO

- Flemington, MO

- Springfield, MO

Your Search For Remarkable Small Business Insurance Ends Now.

Do you feel overwhelmed when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Giana Andrews help you learn about excellent business insurance.

One of the top small business insurance companies in Bolivar, and beyond.

No funny business here

Protect Your Business With State Farm

Whether you are a veterinarian a fence contractor, or you own a candy store, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Giana Andrews can help you discover coverage that's right for you and your business. Your business policy can cover things such as loss of income and extra expense and money.

At State Farm agent Giana Andrews's office, it's our business to help insure yours. Reach out to our outstanding team to get started today!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Giana Andrews

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.